Get Your Uninsured Motorist Coverage Questions Answered by a Pensacola Auto Accident Lawyer

Hear from Pensacola car accident lawyer Eric Stevenson as he gives answers to what to do if you are in a car wreck and the at-fault driver does not have insurance or enough insurance. You might think you will end up footing the bill for all your medical bills and expenses, but he explains how this may not necessarily be the case and how important it is to have uninsured motorist coverage.

Transcript for What if the At Fault Party in a Car Accident has no Insurance?

Is there anything I can do if I’m injured in an auto accident and the at-fault party does not have insurance?

Hi, I’m Eric Stevenson with Stevenson Klotz Injury Lawyers. And that’s a question we get a lot.

You know, people get in a car wreck and the other person doesn’t have enough insurance, especially in Florida where you don’t have to actually have bodily injury coverage at all. It’s very common for the other person to have no insurance to pay for your injuries.

So there are a few things to keep in mind.

What Personal Injury Protection (PIP) Insurance Covers

The first is that your personal injury protection insurance (PIP) will pay for the first $10,000 of your medical treatment.

So go get treatment. Your auto insurance is going to pay for that. That’s what you have auto insurance for under Florida law. And the other person’s insurance doesn’t matter as far as that’s concerned. So go get the treatment you need.

What Health Insurance Covers

The second part is if you have health insurance, health insurance will start paying after the auto insurance pays.

Uninsured Motorist Coverage (UM) or Underinsured Motorist Coverage (UIM)

Then how do you recover money for the injuries not just your medical bills, but for pain and suffering and all the other inconveniences that you have associated with your injuries? Well, you’re going to want to look at your insurance policy and see if you have paid for uninsured or underinsured motorist coverage. It will pay in those circumstances where the other person doesn’t have insurance or has very little insurance.

It will pay you pursuant to the contract you have with your insurance company. So check there. Get with your insurance company, find out if you have it.

How to Protect Yourself from Uninsured or Underinsured Drivers

Now, if you’re watching this video and you don’t have uninsured motorist coverage, go get it. You want to make sure you have it because there’s so many people on the road right now driving without insurance or with very little insurance. You’ve got to look out for yourself. Okay? You got to look out for number one. That’s why they call it number one, right?

So make sure you get the insurance you need to protect yourself rather than relying on other people to be responsible. Because as we all know, there are many irresponsible people out there.

Have More Questions? Call Us

So, again, if you have any questions about auto accidents, about insurance, always feel free to call us.

I hope I’ve been able to answer your question. My name is Eric Stevenson. I’m with Stevenson Klotz Injury Lawyers. My number is (850)444-0000. And remember, we put lives back together.

Uninsured Motorist Statistics in the US

According to the 2021 edition of the Insurance Research Council (IRC) Uninsured Motorist report, one in eight US drivers on the road in 2019 had no insurance. The uninsured motorist rate for the country was 12.6%. But it was even worse in Florida.

Florida Uninsured Motorist Coverage Stats

In Florida, a staggering 20.4% of motorists on the road in 2019 were uninsured. This makes Florida one of the top 6 worst states with over 20% of drivers on the road without any car insurance coverage at all. The other states included in this alarming statistic about uninsured drivers include Mississippi at 29.4%, Michigan at 25.5%, Tennessee at 23.7%, New Mexico at 21.8%, and Washington at 21.7%.

Why UM or UIM Coverage is Important to Protect Yourself from an Uninsured or Underinsured Driver in Florida

Having uninsured or underinsured motorist coverage is important for Florida drivers for two main reasons. First, it can provide you with the compensation you need to recover from an accident caused by someone without car insurance or not enough insurance. Second, uninsured motorist coverage protects you in the event that you are injured and the other driver has insufficient coverage to cover your medical bills, lost wages, and other costs.

UM/UIM coverage can help you pay for things like medical expenses and property damage caused by an uninsured or underinsured driver. It can also provide compensation for pain and suffering and emotional distress that resulted from the accident.

Adding UM/UIM Coverage to Your Car Insurance Policy

To find out if you have uninsured motorist coverage or underinsured motorist coverage, contact your insurance company and review your current policy. If you don’t have UM coverage, you can add it to your policy. Adding uninsured or underinsured motorist coverage is recommended for all Florida drivers, as the risk of encountering an uninsured driver on the road is high.

Florida Auto Insurance Laws

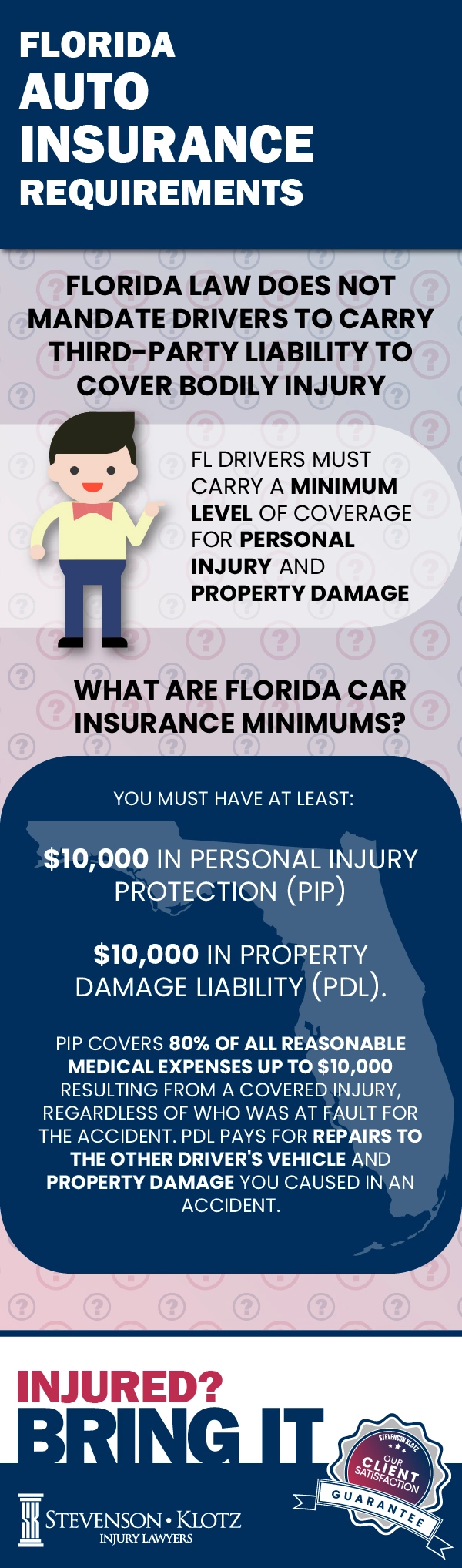

Unlike most states, Florida law does not mandate drivers to carry third-party liability car insurance coverage on their vehicles to cover the costs of treating any bodily injury caused in a car accident. Instead, Florida requires drivers to carry a minimum level of auto insurance coverage for personal injury and property damage.

This includes $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). PIP covers 80% of all reasonable medical expenses up to $10,000 resulting from a covered injury, regardless of who was at fault for the accident. PDL pays for repairs to the other driver’s vehicle and property damage you caused in an accident.

Why PIP minimums are not enough

According to the National Highway Traffic Safety Administration (NHTSA), the average costs for injuries resulting from a motor vehicle accident exceed $15,000 when accounting for missed work and costs of long-term recovery.

Get uninsured motorist coverage to avoid out of pocket expenses

So, having the minimum amount of PIP coverage may not be enough to cover all of your medical expenses and bills after a motor vehicle accident. Also, if you are in a crash with an uninsured driver and/or don’t have UM/UIM coverage, it is possible that you will be left paying for damages out of pocket. This could be financially devastating to you and your family. To fully protect yourself from uninsured or underinsured drivers on the road, it is important that you carry higher limits of liability coverage as well as uninsured and underinsured motorist coverage. This can protect you from uninsured motorist property damage as well as damages like lost wages, your own medical expenses or future medical expenses, hospital bills, and more.

Motorist bodily injury coverage in Florida

Bodily injury liability coverage (BI) is not required under Florida law. By contrast, almost every other state in the nation requires all drivers to pay for bodily injury coverage to be included in their auto insurance policies. This is so that when an accident occurs due to the policy owner’s negligence or mistake, the injured party is able to file a motorist bodily injury coverage claim to help pay for medical bills and treatment expenses.

What to Do After an Accident with an Uninsured Motorist

If you are injured in an accident with an uninsured or underinsured motorist, make sure to seek medical treatment, document the accident, report the accident to the police, report the accident to your insurance company, and get help from a car accident attorney. An experienced attorney can help you navigate the legal system and negotiate with the insurance companies for the compensation you deserve.

Get medical attention immediately

If you have been injured in an accident, it is important to get medical attention as soon as possible. Even if you don’t think you have a serious injury, it is still important to seek treatment from a doctor who can diagnose and treat any potential injuries that you may be unaware of.

Document the accident

You should document the scene of the accident with photos, videos, and witness statements. This will help bolster your case if you decide to pursue a claim against the other driver’s insurance company or file a lawsuit against them.

Report the accident to police and your insurance company

If you are involved in an automobile accident, it is important to call the police and report the accident. You should also report the accident to your insurance company as soon as possible so that they can begin making arrangements for coverage or filing a claim.

Get help from an experienced car accident attorney

The process of filing a claim against an uninsured or underinsured driver may be confusing and frustrating. An experienced car accident attorney can help you navigate the legal system and protect your rights. They can also help you maximize your compensation so that you are able to cover any loss or damages incurred due to the accident.

Get Legal Help if You’re Injured in an Accident with an Uninsured Motorist

If you have been seriously injured in an accident with an uninsured or underinsured motorist and don’t know what to do, contact a personal injury lawyer for help. An experienced attorney from Stevenson Klotz Injury Lawyers can review your case and inform you of your rights and legal options. We are here to help you and your family get through this difficult time.

Call Stevenson Klotz Injury Lawyers Today

With over 54 years of combined experience, we provide exceptional, personalized client service. We will fight to make sure you receive the maximum compensation allowed by law. Contact us today for a free consultation.